- Home

- Technology

Try RE Logic for yourself

Save time using RE Logic to access data, appraise, list and sell properties.

- Research

Sign up to the newsletter

Stay tune with RE Logic’s products and projects

- Product & Service

- Insights

- About

Save time using RE Logic to access data, appraise, list and sell properties.

Stay tune with RE Logic’s products and projects

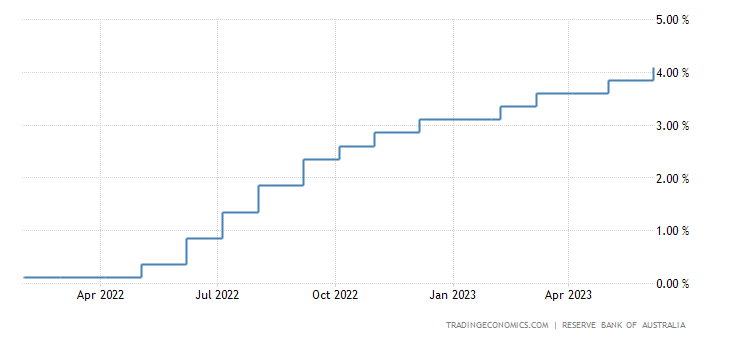

In a move that has sent shockwaves through the market, the Reserve Bank of Australia (RBA) has announced yet another interest rate hike. This 12th consecutive increase of 25 basis points and warning for more hikes not only defied market expectations but also shattered any lingering hopes of an imminent end to the rate rises. This makes the 12th hike substantially different from the 11th.

The RBA’s decision to raise the cash rate for the 12th time in a row comes as a surprise to many, as the market had been anticipating a potential slowdown in rate hikes. With the previous rate hike failing to quell speculations of an impending halt, this latest move by the central bank has reinforced the belief that interest rates may continue to rise in the foreseeable future.

Consumer sentiment, which plays a vital role in driving economic activity, is likely to be significantly influenced by this 12th rate hike. The unexpected nature of the decision has caught many off guard, leading to a potential erosion of consumer confidence. With the cost of borrowing increasing, consumers may adopt a more cautious approach to spending, affecting sectors such as retail, automotive, and housing.

The property market, in particular, is expected to bear the brunt of this rate hike. Property buyers, who were already contending with rising prices and tighter lending conditions, are now to face further challenges. The increase in interest rates makes home loans less affordable, impacting demand for properties and hence slowing down price growth. It is likely to dampen buyer sentiment and prompt a more cautious approach to property purchase. The uncertainty surrounding future policy decisions have introduced an element of volatility into the market. In the short term, this may result in a period of adjustment as buyers and sellers recalibrate their strategies in response to the changing financial landscape.

Subscribe to our weekly newsletter to get updated on new projects